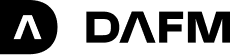

July performance and newsletter

Another good performance in July (2.67% after fees) as the digital asset yield structure remained volatile in a month mirroring June in many ways. We believe crypto as an election issue will remain a persistent source of volatility for markets and feel well placed to take advantage of those changes in sentiment as they evolve.

June performance and newsletter

Another solid performance in June (1.88% after fees) as the digital asset yield curve remained volatile. There were no significant events to speak of, just a steady flow of trading between exchanges and yield maturities, enhancing our alpha extraction. We continue to increase volumes on the CME and look forward to strategy enhancements on Deribit and OKX exchanges shortly.

Hedgeweek Global Digital Assets Award 2024

Digital Asset Funds Management’s Digital Income Class (previously know as Opportunities Class) won the Hedgeweek Global Digital Asset Award for Relative Performance of the Year – Digital Assets Fund (Trailing 24 Months).

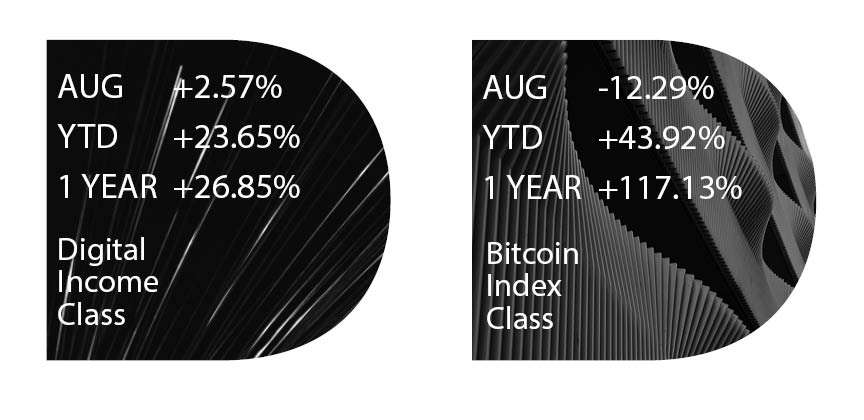

May performance and newsletter

The trading environment in May paled in comparison to April as we saw a steady increase in the dated futures yields without any commensurate uptick in the volatility. With the yields at loftier levels at month end than where they started we expect the near term performance of the strategy to remain solid. We returned to trading on the CME as the yield differential between there and the other exchanges tightened. Further system enhancements have been deployed during May, with more in the pipeline over the coming months.

3 Year Investor Report

Digital Asset Fund has reached a 3 year milestone! The ‘Investor Letter’ takes you through the successful journey of Digital Asset Fund since its launch in 2021.

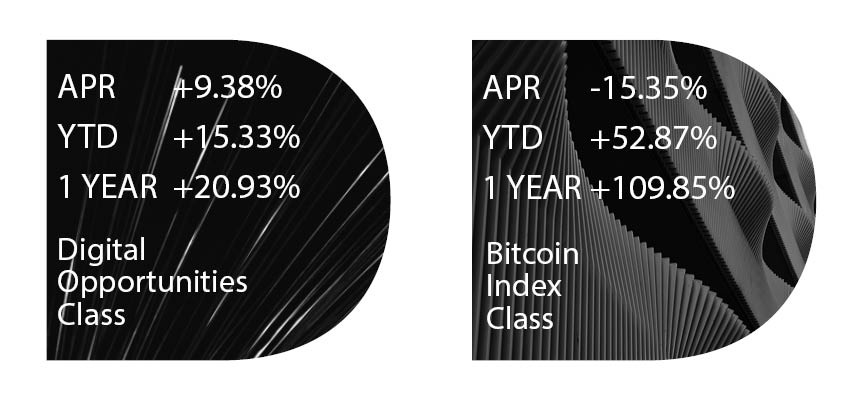

April performance and newsletter

April provided the most fertile trading environment for the strategy since DAF’s launch in May 2021, with a 9.4% return after fees. A nice birthday gift for our investors! Coming into the month we observed an ultra high yield environment in the digital asset space and significant variability across exchanges. The yield remained consistently volatile but also trended lower which, combined with a few sharp liquidations, contributed to the strong overall return. Of note, given the structure of the yield curve in the crypto native exchanges, we made the rare decision to minimise our CME exposures and optimise our capital usage. In due course we will look to resume trading there. Additionally, we began trading a broader array of derivative instruments in OKX and will roll that out to other exchanges in the coming weeks.

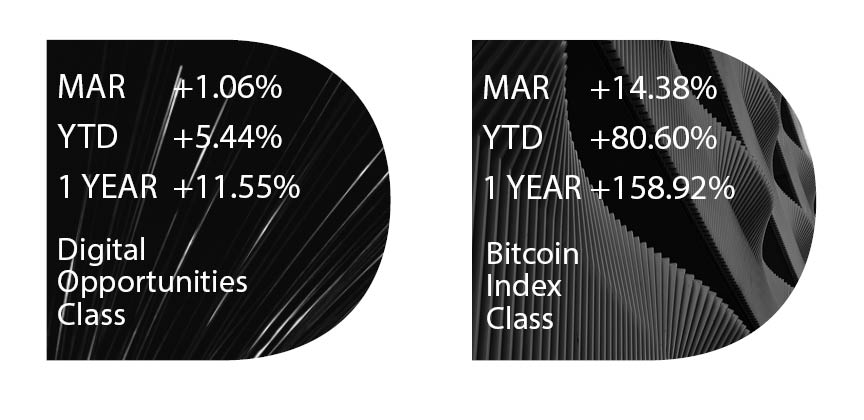

March performance and newsletter

The fervent trading environment has seen yields continue to make new recent highs, albeit with relatively subdued short term volatility keeping trading profits suppressed. The fund continues to have a material amount of carry marked into the curves – if history is anything to go by we will realise this when the market inevitably deleverages. The most notable market dynamic is ETH yields outperforming BTC at times, in particular the short end. Fundamentally we would expect proof-of-stake ETH to trade at a relatively flat yield to USD, suggesting there are some participants expecting an ETH ETF to follow in short order.

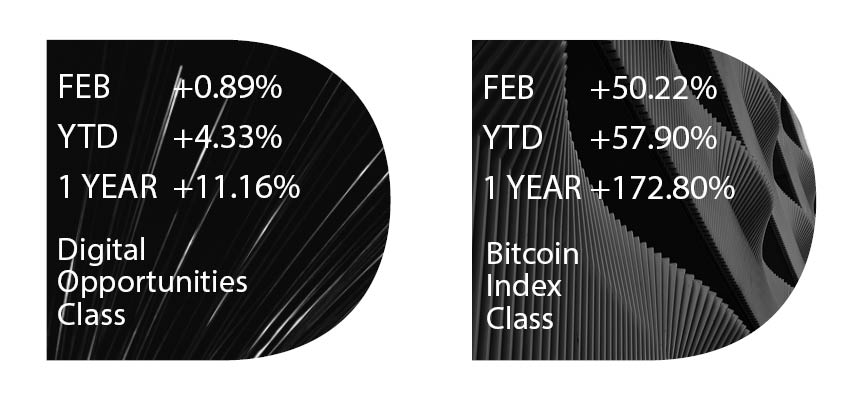

February performance and newsletter

Overall February was a good month for the strategy. Whilst the headline return was moderate, the position has a large amount of embedded carry that should be realised in the coming months. Volumes were good, although not to the same level as we saw in January. We’re beginning to observe a shift in the CME landscape as traditional market participants now have access to the yield arbitrage between holding a long spot ETF position vs selling a future. This was long mooted and is now occurring. What this implies for the longer term trading of the CME futures for the strategy is still not wholly clear but will unfold in the next few months.

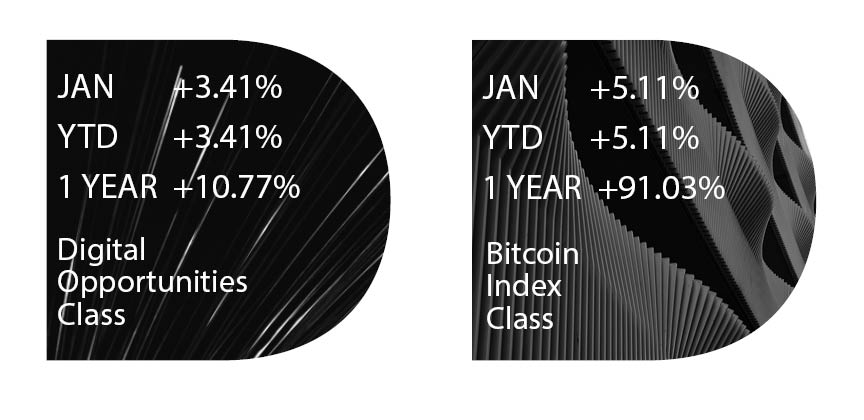

January performance and newsletter

January proved to be the best month for the strategy since the heady days of 2021. This was due to a combination of factors: multi year highs in long dated futures yields, significant sustained volatility, liquidation events, consistently high trading volumes and the popularity of the BTC ETFs. With implied yields remaining favourable, the impact of the BTC and potentially ETH ETFs in the market and the BTC halving in April, we expect to see a continuation of the friendly trading environment. Additionally, on the trading system side we expect to go live with a suite of new instruments across the bulk of exchanges we trade on, leading to more opportunities.

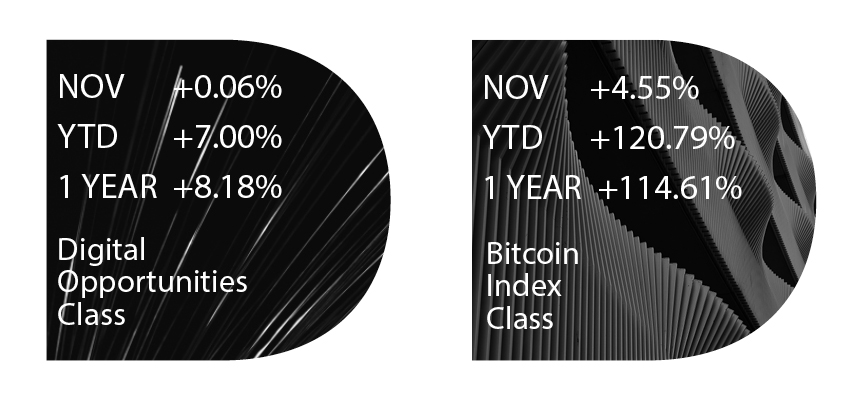

November performance and newsletter

The unidirectional move provided less trading opportunities than we’d hoped. Coupled with the increasing futures yields (12% in March 2024 for example) that we continue to sell into meant the overall performance was modest. We expect that this yield environment will be conducive to a more profitable future return profile.