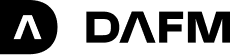

May performance and newsletter

BTC rose to a new all-time high of $111,970 on 22 May.

Despite the record high, BTC futures yields were not

overly responsive, but they did hold up well throughout

the spike and volatile period. BTC seems to be trading

more like gold as time goes on.

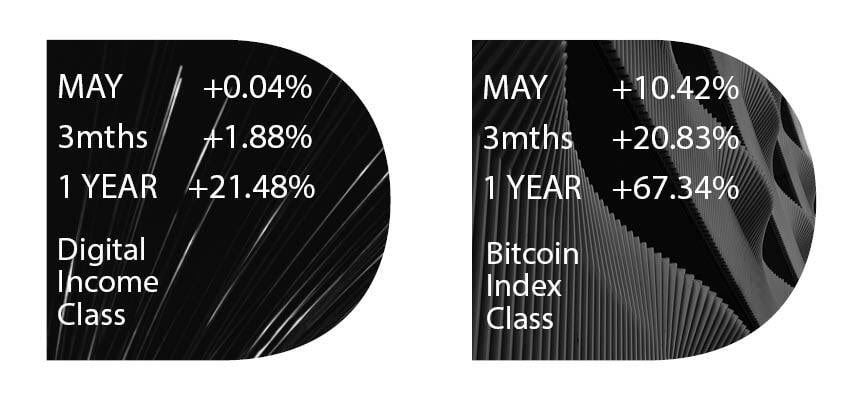

April performance and newsletter

Basis volatility (the premium futures command over

spot) was muted throughout the month, with yields

never really finding a bid even toward the back end of

April’s recovery. At times CME yields decoupled from

broader crypto-centric venues, which provided a

convenient avenue for returns. Otherwise, the system

took advantage of inter/intra exchange opportunities as

they became available.

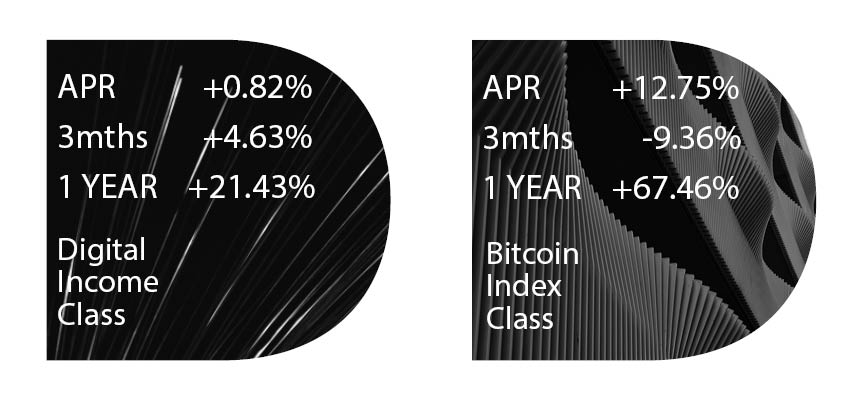

March performance and newsletter

“Trump-pumps” seem to be a thing of the past for the

time being. Various headlines regarding Trump related

entities buying alt-coins or spruiking Ripple (XRP) as a

viable payment platform failed to spark any ongoing

buoyancy in the market. Consequently, it was a

relatively benign month in terms of crypto-centric

news. BTC remained heavy as did ETH and alt coins.

Indices reflecting “Fear and Greed” approached the

year’s low for BTC.

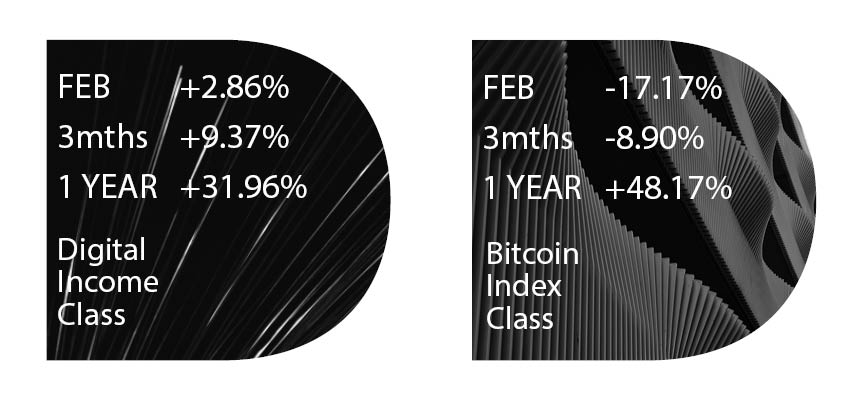

February performance and newsletter

There were two notable events in February. First, a liquidation event in early February, which caused Ethereum to fall some -15% within 1 minute.

The second event was news that the Bybit crypto exchange had been hacked for some US $1.5bn worth of Ethereum.

Despite the immediate fall in ETH and BTC, it was not as large a fall as that following the November 2022 FTX fraud.

Helping the market to stabilize and recover was the very quick and open communication by Bybit’s CEO.

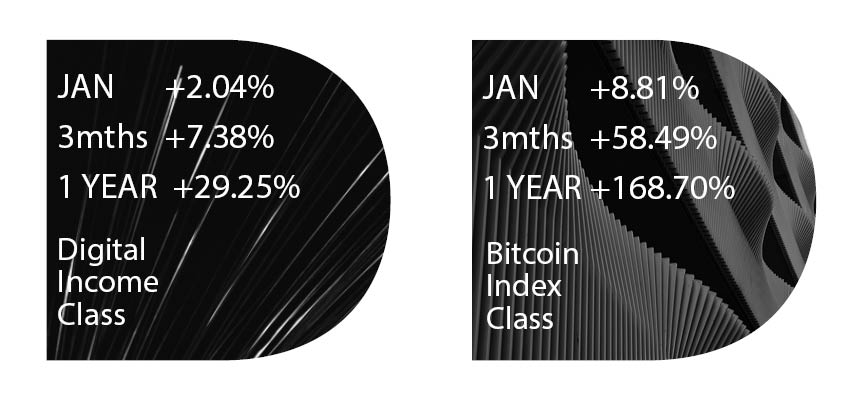

January performance and newsletter

The month of January saw the inauguration of Donald Trump as U.S. President. The 20th January inauguration coincided with Bitcoin printing at a new all time high just below US$110,000.

The record high in Bitcoin appears to be driven by the perception that President Trump remains a crypto friendly U.S. President. Trump has announced a variety of crypto-friendly cabinet heads and has been communicating optimistically about the role of crypto in the United States.

Over coming months, the market will learn more about Trump’s plans in the crypto space.

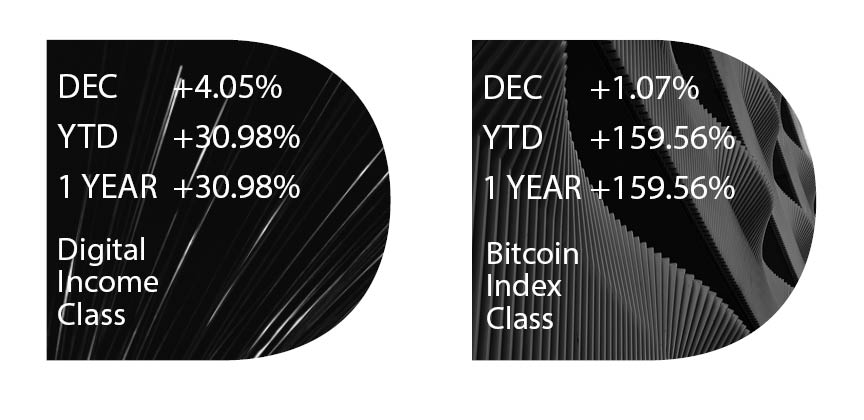

December performance and newsletter

A busy month of trading activity in December, with futures basis and spot both volatile over the month. We saw some great trading opportunities across all the main crypto exchanges and expect these trading opportunities to continue over the new year. A potentially interesting development over 2025 will be the continued increase in options-related activity as ETF options increase in popularity. Additional liquidity in ETF options should broadly assist basis market liquidity, which will in turn assist trading opportunities in the Digital Income Class.

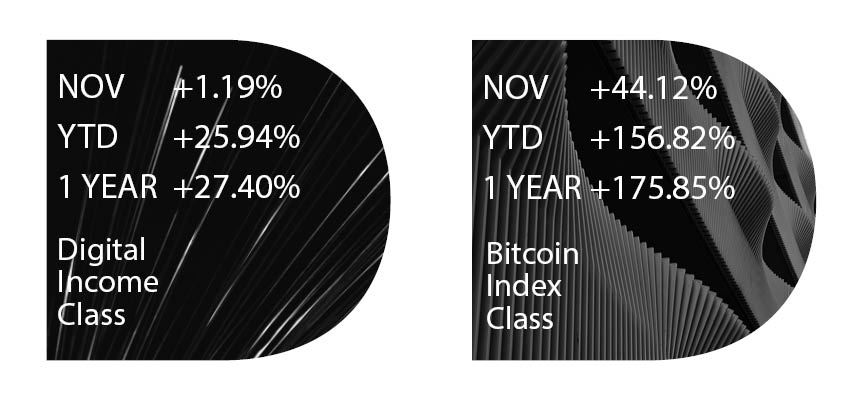

November performance and newsletter

November was a busy month of trading activity. There were good volumes in the futures spread across both the Deribit and Okx exchanges. Futures basis found a steady bid, in line with a strong bid in spot. The market was relatively well behaved. However, we would expect it to become more chaotic, and conducive to the volatility strategy, if $100k convincingly breaks to the upside.

We’re starting to see the benefits of our engineers’ development work undertaken earlier this year, on DAFM’s algorithm.

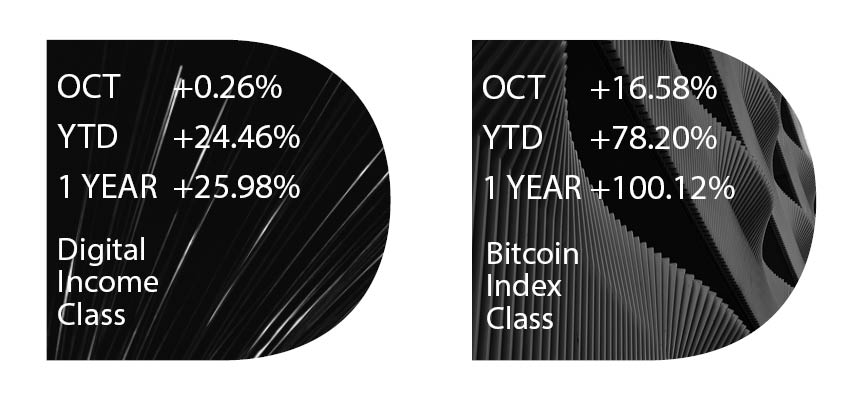

October performance and newsletter

Crypto markets were relatively benign until the final days of the month as we approached the US election. The march higher and then through 70k in BTC saw yields rally materially which the strategy took advantage of. The uptick in yields and prices also saw the return of trading/volume differences

across venues and contracts. The desk remains prepared to take advantage of November’s volatility regardless of the outcome.

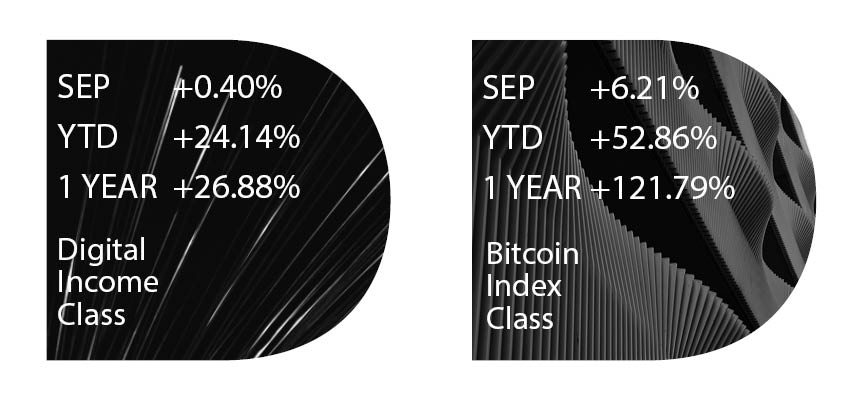

September performance and newsletter

Yields remained subdued from the tail end of August. The strategy captured cross-exchange opportunities when they presented during sporadic bursts of volatility. The addition of futures spread products delivered a positive incremental source of returns.

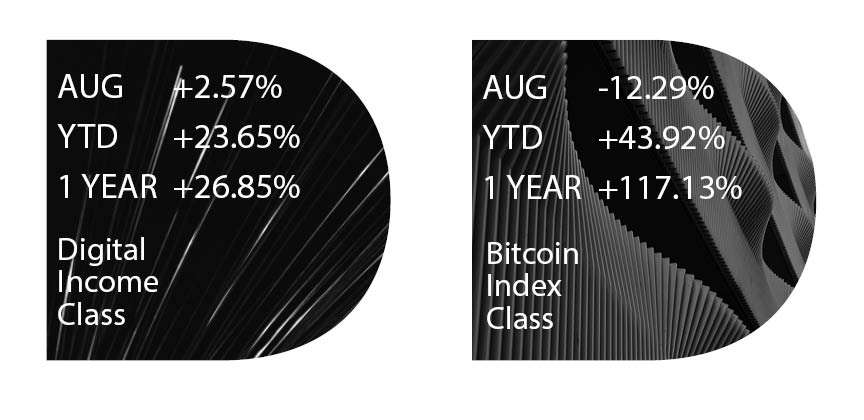

August performance and newsletter

Another great month due to the volatility of the basis throughout the month. Absolute yields haven’t bounced back to the lofty heights seen at the start of August, but we remain well placed to capture value from any volatility that results, whether cryptocentric induced or otherwise.