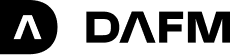

August performance and newsletter

Overall a busier month than we’ve encountered for some time. Whilst overall movements in spot and basis were range bound, we did enjoy a particularly violent sell off on the 18th. This occurred during the period where the CME Futures were closed in early Asian trade, a generally illiquid time. We were able to capture many of the opportunities that presented themselves in that 30 minute period, and this episode contributed to over half the monthly return. The move itself was largely driven by technical actors in the options market and we saw all the futures dislocations in Deribit, the principal options trading venue.

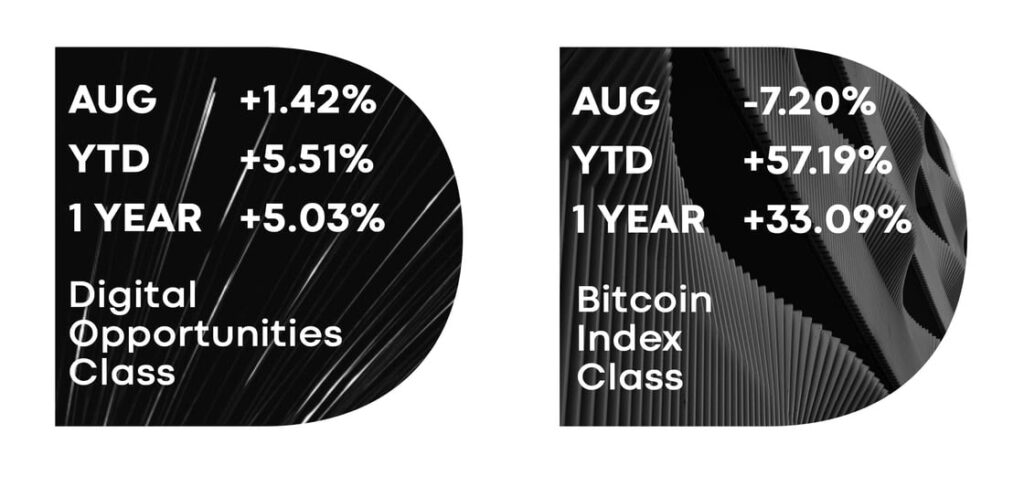

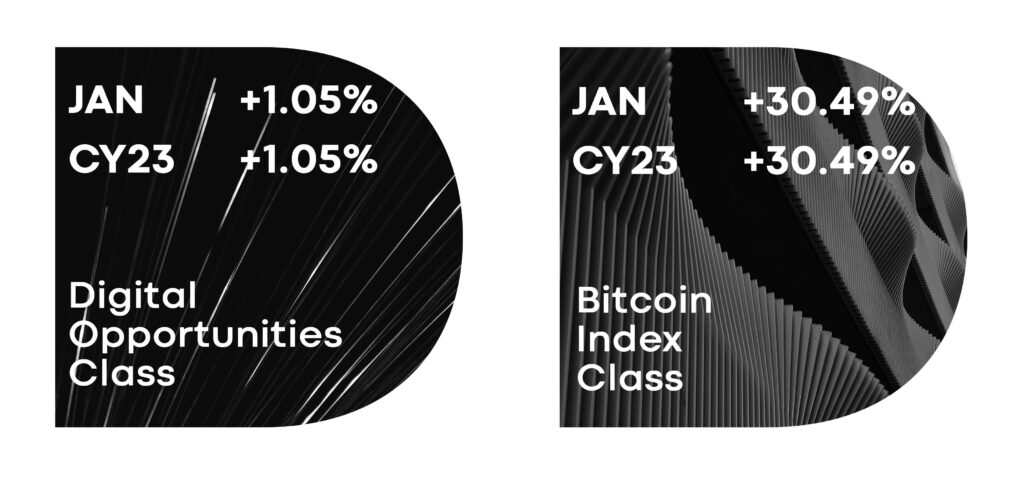

July performance and newsletter

July continues on from prior months with CME yields remaining bid over centralised exchanges. The suite of support services continues to expand in the crypto space. We’ve had tentative discussions with providers that aim to provide prime brokerage or trading bridge support to help streamline our capital efficiency and market access

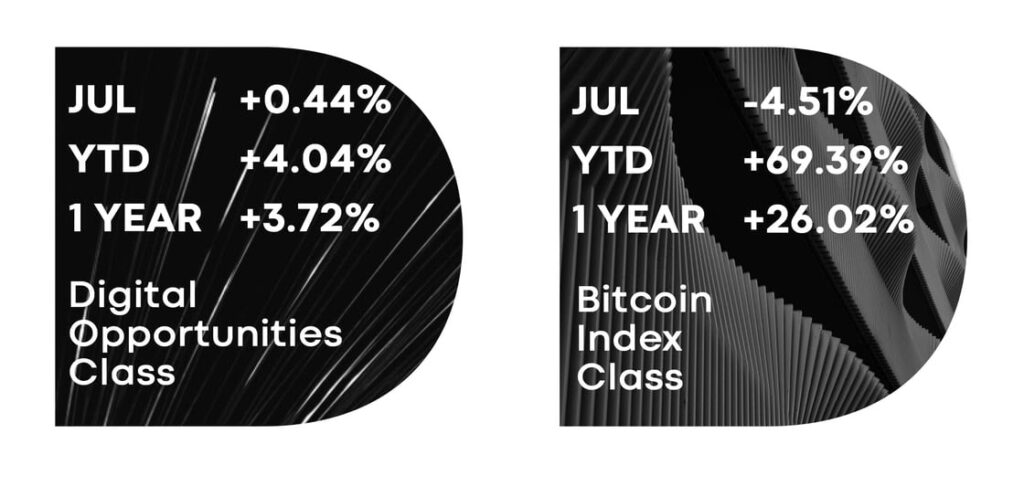

June performance and newsletter

CME yields continued to be bid over centralised exchanges over the course of June, with short date yields printing as high as 30%. We expect the CME to continue being indicative of institutional positioning after the implicit endorsement from BlackRock’s ETF application – the June23 BTC roll market was the most active we have ever seen into expiry along with open interest approaching all-time highs in the active contract. We have the infrastructure available to take advantage of these opportunities and continue to explore options to reduce the friction required to capture them.

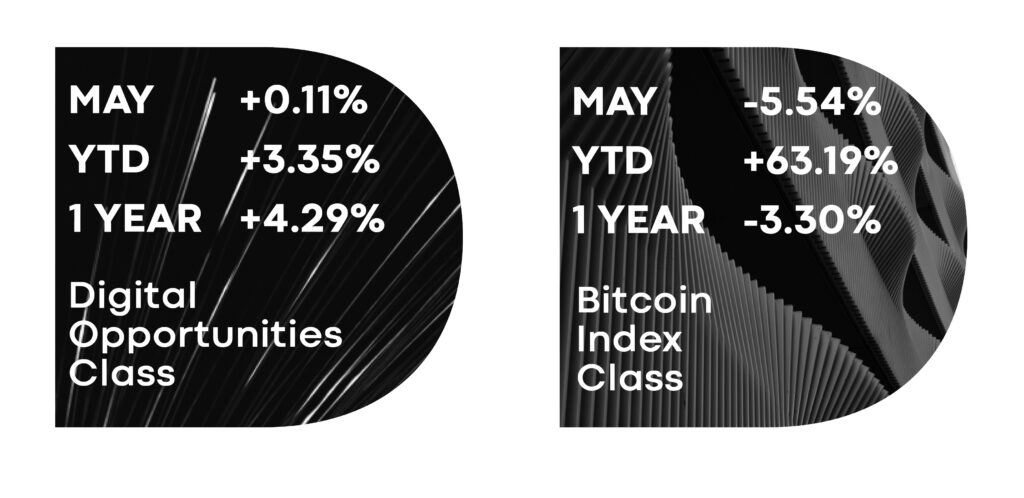

May performance and newsletter

On the trading side there wasn’t a lot to note. As a potential consequence of the continued SEC clampdown on crypto exchanges, the CME becomes the venue to where institutional money prefers to hold crypto exposure. With yields not insignificant, the carry cost may become a factor.

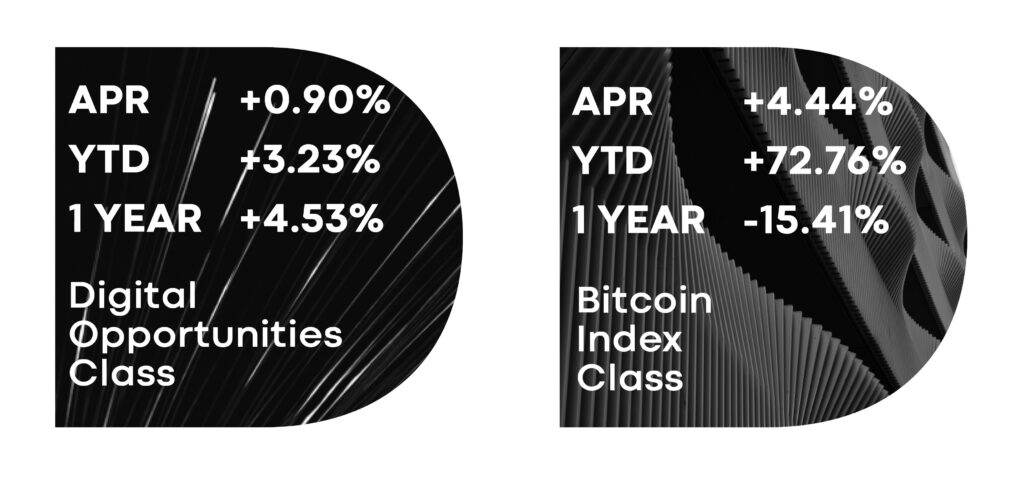

April performance and newsletter

April marked continued favourable trading conditions for the DAFM strategy with yield dislocations persisting between crypto native exchanges. CME continues to attract institutional interest . A majority of the opportunities have been seen in BTC, with ETH mostly a sideshow. We continue to work on deploying stablecoin denominated futures into the broader DAFM strategy in addition to exploring custody solutions that mitigate counterparty credit risk. The team adhered to collateral quotas, having no more than 12.5% of funds on deposit per crypto native exchange.

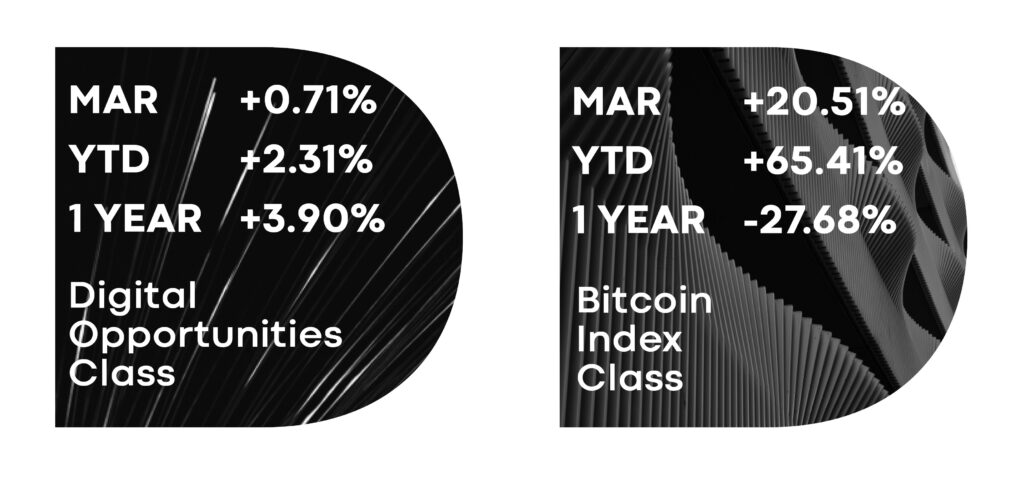

March performance and newsletter

A similar trading environment to February as market participants that left the market post FTX are slow in returning. This increased illiquidity is generally a positive for the DAFM strategy and we’d be happy for it to persist. The main opportunities we see remain in the CME vs crypto native exchanges where different types of market participants reside. Institutional vs retail predominantly. Development work continues, we aim to integrate stablecoin denominated and margined futures into the trading system in the coming months

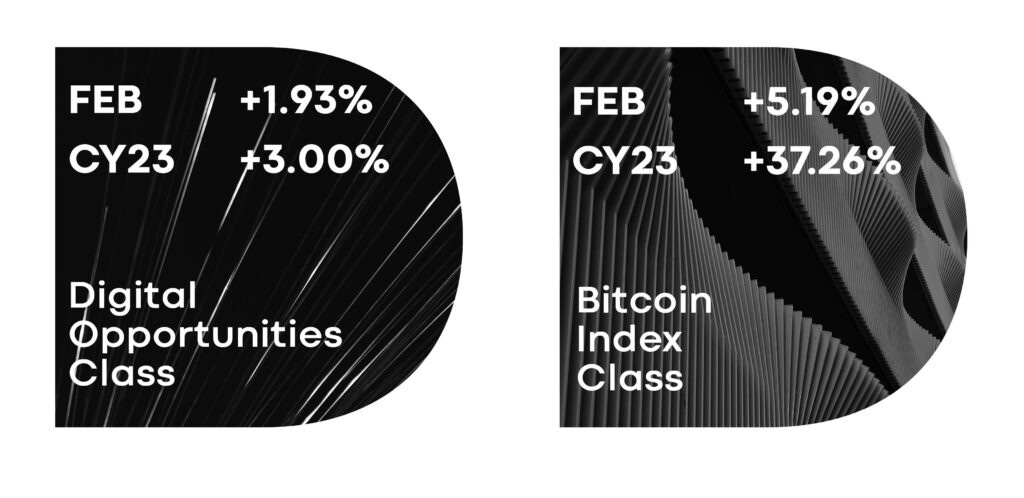

February performance and newsletter

We saw similar market conditions to January as the fallout from the FTX implosion continues to wash through the industry. Leverage continued to return the market, observed via higher implied yields in the futures and perpetuals, as they rose to levels we hadn’t seen since the middle of 2022. Higher implied yields are the best marker for profitability of our strategy. Trading spreads stayed relatively wide and liquidity still hasn’t meaningfully returned. We continued to observe institutional funds coming back into the market via the CME. We maintained tight control on individual capital quotas at exchanges, keeping no more than 12.5% at any exchange during the period.

January performance and newsletter

Leverage crept back into the market with the move higher in spot. We saw this in both futures and perpetual yields across all the instruments we trade. This was coupled with wider spreads and thinner liquidity as market participants withdrew post FTX to provide the most fertile trading environment for our strategy since 2021. Notably, we saw significant interest in the CME, where we observed a marked shift in positioning from institutional money as they cut shorts and turned long for the first time since mid 2022. We maintained tight control on individual capital quotas at exchanges, keeping no more than 10% at any exchange during the period. We note that there’s been a distinct change in sentiment from crypto native exchanges post FTX, where there’s a much higher degree of transparency around assets held on exchange, and also in exploring novel methods for removing counterparty exchange risk by holding client assets in third party and escrow accounts. Something we wholeheartedly embrace.

October performance and newsletter

October was a particularly uneventful trading month, in hindsight, the lull before the storm. Spreads to the spot price, and the volatility of those spreads remained in tight ranges, providing a barren landscape of trading opportunities. For the first time in crypto’s history there was more volatility in traditional markets than crypto, with USD interest rates the main driver in the traditional markets.

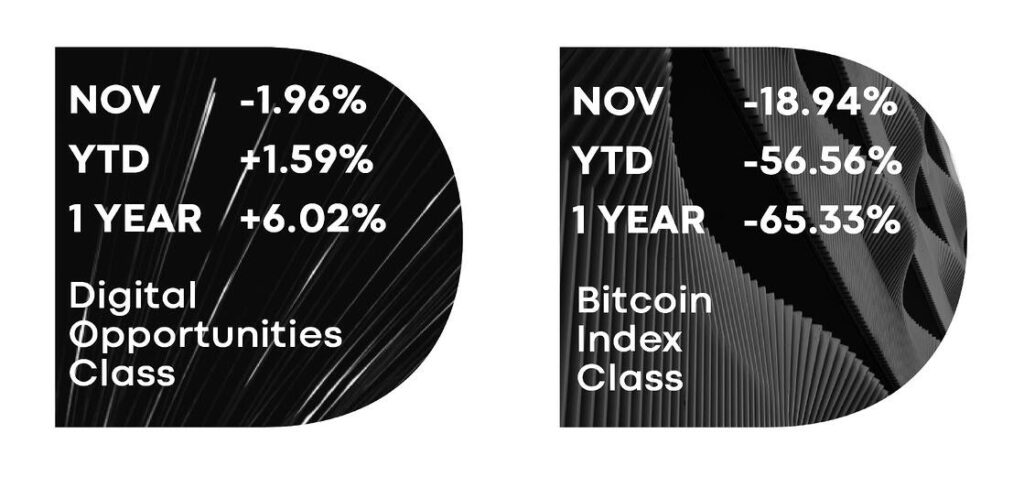

November performance and newsletter

A quiet start to the month, which was then dominated by the collapse of FTX. Unfortunately related to this was the destruction in value of exchange coins that we held in order to qualify for reduced trading fees, causing further fund underperformance. The post FTX crypto landscape provided a fertile trading environment, with high volatility across venues. In the week after the collapse the principal driver of profitability was the large and volatile spreads between the CME and crypto native exchanges. As the opportunities of the CME against crypto exchanges waned, we saw other opportunities between crypto native exchanges as they took turns in trading more expensively relative to each other.