January 2026 performance and newsletter

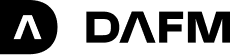

The Digital Income Class (the Fund) rose 0.18% over the month of January,

bringing its 12-month performance to 12.38% net of fees.

Cryptocurrency markets started the year strongly. However, sentiment

deteriorated in line with broader macroeconomic concerns. The trading desk

saw limited opportunities to build on stubbornly low yields.

December performance and newsletter

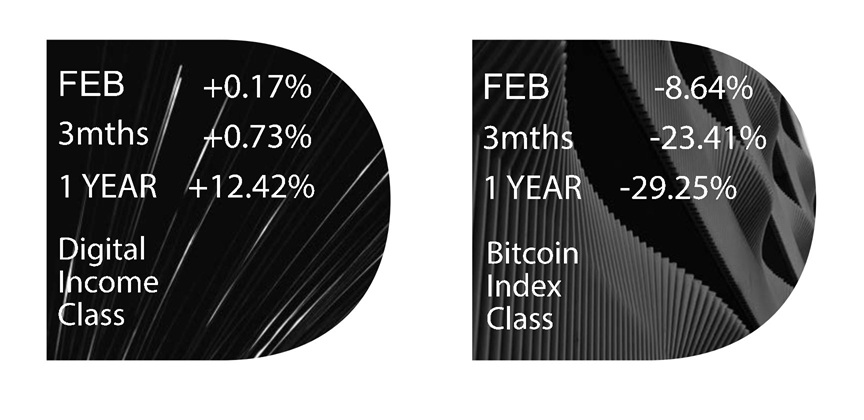

The Digital Income Class (the Fund) rose 0.08% over the month of December,

bringing its 12-month performance to14.64% net of fees.

Trading opportunities were limited due to the quiet end to the year in

cryptocurrency markets. However, low market yields still allowed the Fund to

generate a small positive return.

November performance and newsletter

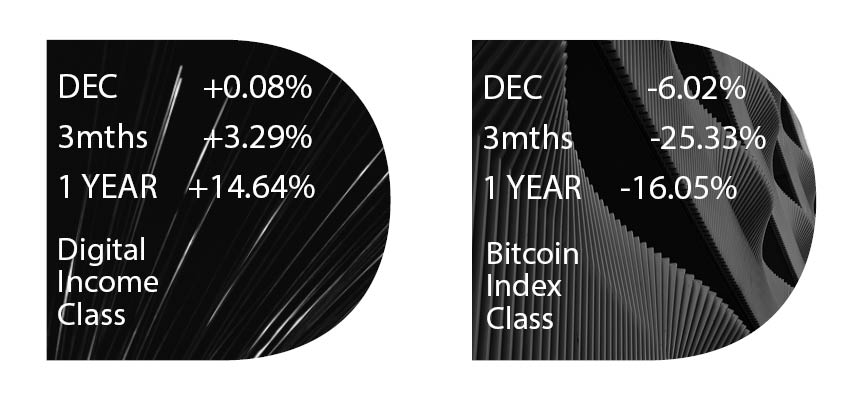

November was volatile for cryptocurrency markets. Bitcoin fell from above US$100,000 to just over US$80,000 before recovering to around US$90,000. The decline reflected ongoing market caution from October’s tariff news and higher-than-expected U.S. inflation, which pushed investors toward safer assets.

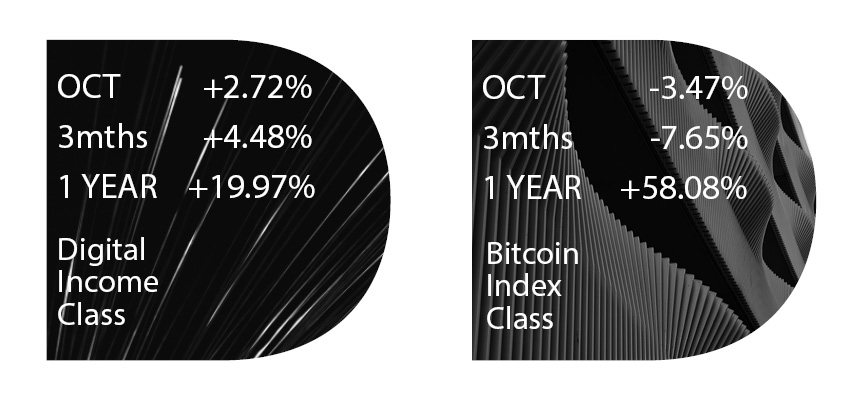

October performance and newsletter

October’s trading opportunities capitalised on the volatility driven by the

US and China events on 10 October. The largest single day return of the

year again demonstrated the value of our market neutral approach and

proprietary trading systems. The Fund consolidated profits through the

rest of the month, delivering strong consistent performance.

DigitalX Investment

DigitalX ASX Announcement

“DigitalX board has resolved to allocated approximately A$4.96 million into the Lime Street Capital SPC fund, run by Australian manager Digital Asset Funds Management (DAFM), which is expected to generate significant free cash flows based on the Fund’s historical performance.”

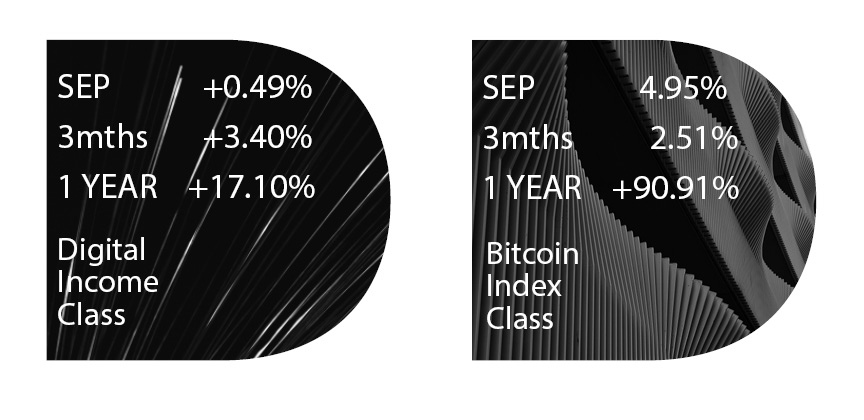

September performance and newsletter

Early September saw headline cryptocurrency Bitcoin

(BTC) consolidate from its decline in August. Although

BTC failed to find any solid momentum in September, late

in the month, U.S. dollar weakness saw crypto assets

start to move higher again.

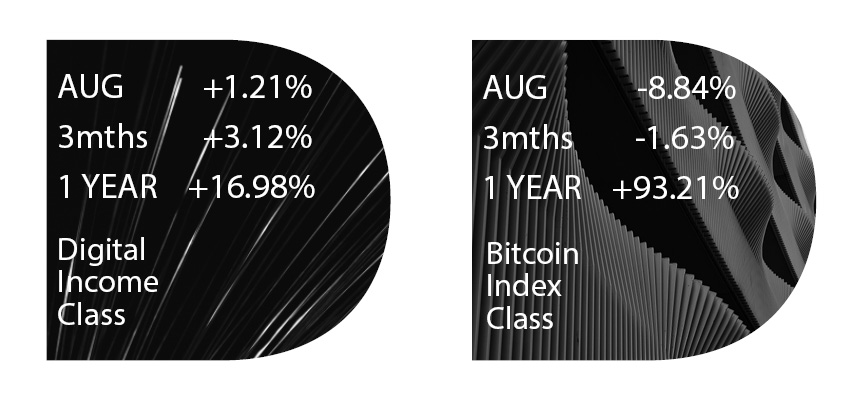

August performance and newsletter

Bitcoin set a new all-time high in August, trading above

US$124,000 for the first time. Positive sentiment was

driven by increased institutional backing and further U.S.

regulatory support, notably easing rules around holding

cryptocurrency in retirement accounts. The new high in

BTC found strong resistance, and profit-taking saw prices

settle around $108,000 by month-end.

Montgomery Partnership

Montgomery Investment Management (Montgomery) is

pleased to announce an exclusive partnership with Sydney’s Digital Asset Funds

Management (DAFM), introducing a unique opportunity for Australian investors beyond

traditional assets and strategies.

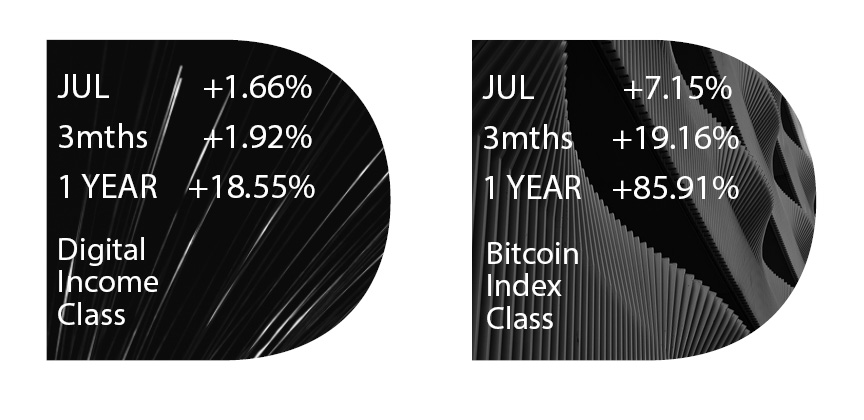

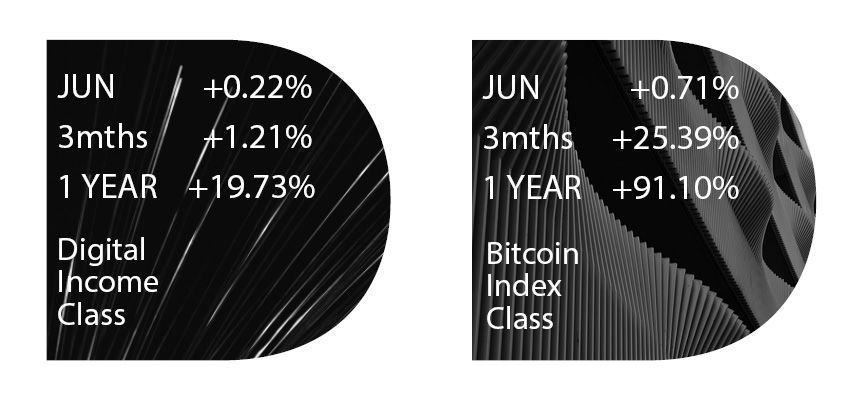

July performance and newsletter

Similar to the equity market, the crypto market is pricing

in further interest rate cuts from the Fed and many

developed market central banks. Positive U.S. regulatory

momentum continues to build for crypto. The GENIUS

Act was enacted by U.S. President Trump on July 18, and

new SEC Chair Atkins announced plans for major

regulatory reforms on cryptocurrencies at month close.

June performance and newsletter

A similar trend to what occurred last month, where

yields on crypto-specific trading venues remained

below those on the Chicago Mercantile Exchange

(CME). The algorithm was able to take advantage of the

opportunities, particularly as the spread between the

CME and the crypto-specific trading exchanges

narrowed towards the back end of the month.