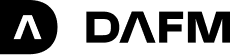

January performance and newsletter

Leverage crept back into the market with the move higher in spot. We saw this in both futures and perpetual yields across all the instruments we trade. This was coupled with wider spreads and thinner liquidity as market participants withdrew post FTX to provide the most fertile trading environment for our strategy since 2021. Notably, we saw significant interest in the CME, where we observed a marked shift in positioning from institutional money as they cut shorts and turned long for the first time since mid 2022. We maintained tight control on individual capital quotas at exchanges, keeping no more than 10% at any exchange during the period. We note that there’s been a distinct change in sentiment from crypto native exchanges post FTX, where there’s a much higher degree of transparency around assets held on exchange, and also in exploring novel methods for removing counterparty exchange risk by holding client assets in third party and escrow accounts. Something we wholeheartedly embrace.

October performance and newsletter

October was a particularly uneventful trading month, in hindsight, the lull before the storm. Spreads to the spot price, and the volatility of those spreads remained in tight ranges, providing a barren landscape of trading opportunities. For the first time in crypto’s history there was more volatility in traditional markets than crypto, with USD interest rates the main driver in the traditional markets.

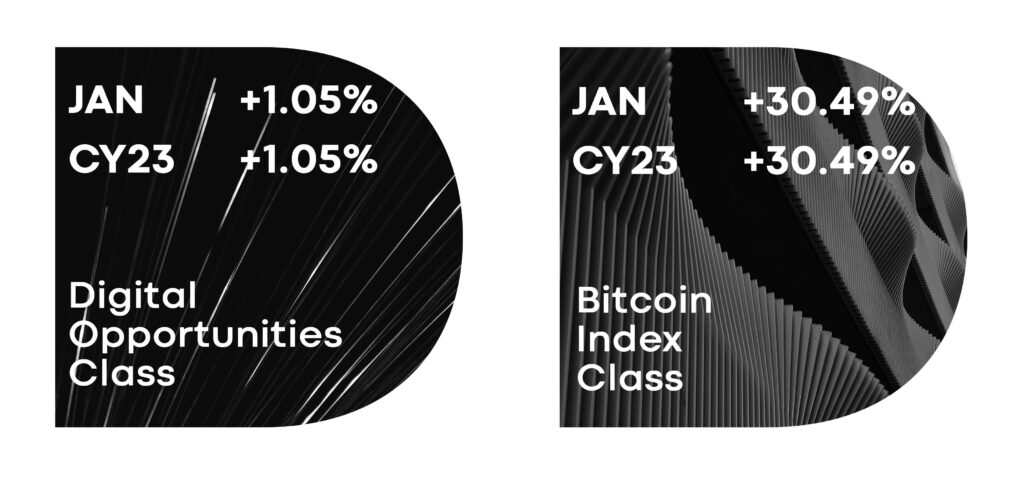

November performance and newsletter

A quiet start to the month, which was then dominated by the collapse of FTX. Unfortunately related to this was the destruction in value of exchange coins that we held in order to qualify for reduced trading fees, causing further fund underperformance. The post FTX crypto landscape provided a fertile trading environment, with high volatility across venues. In the week after the collapse the principal driver of profitability was the large and volatile spreads between the CME and crypto native exchanges. As the opportunities of the CME against crypto exchanges waned, we saw other opportunities between crypto native exchanges as they took turns in trading more expensively relative to each other.

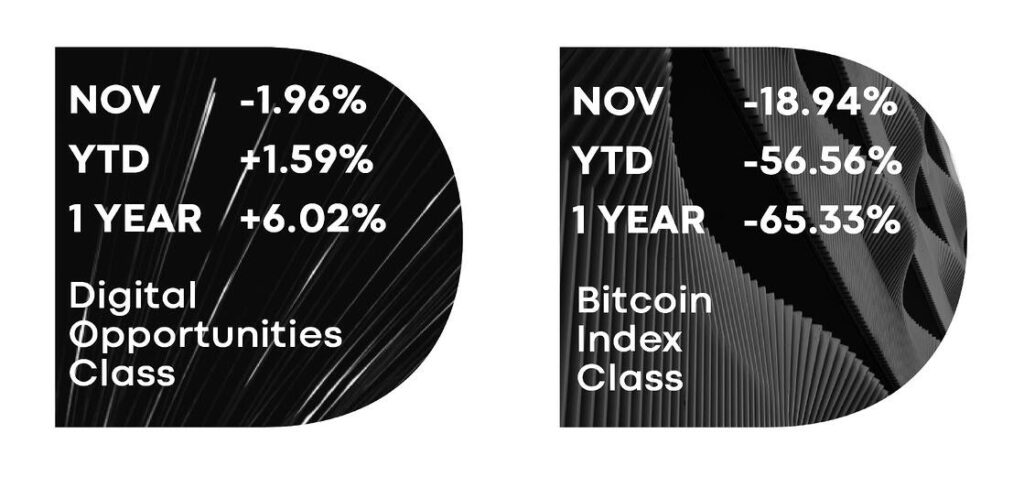

December performance and newsletter

The FTX bankruptcy created the most illiquid market environment we’ve seen all year, as market makers stepped back from derivative markets and counterparty credit risk was at the front of everyone’s mind. The paradox was that volatility remained relatively muted. DAFM implemented tight controls on outright exposure that we’d run in crypto native exchanges as we monitored the observable inflows/outflows. This inhibited our trading activity at times, particularly in Binance, but we were still able to take advantage of opportunities that these markets presented to post a solid monthly return.

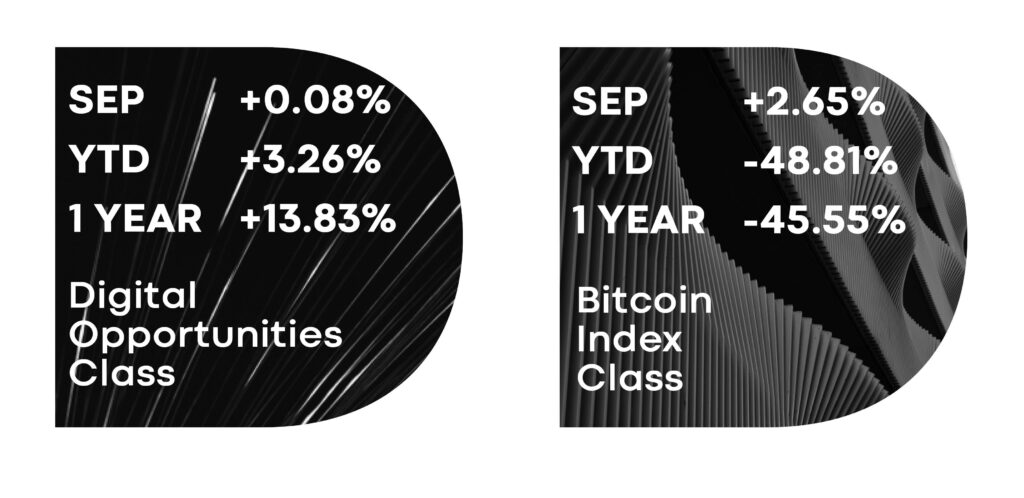

September performance and newsletter

The Ethereum Merge provided a complex trading environment with very little certainty around how the “Forked” Proof of Work token would be created and how it would trade once implemented. Additionally, there was ongoing conjecture around whether the Merge may get delayed all adding to a difficult market to price dated Futures dependent on that information. Bitcoin was largely sidelined during the month with little interest on either side and no leverage to speak of coming into the market. This manifested in a very flat and stable Forward curve. Not an ideal market environment for our strategy.

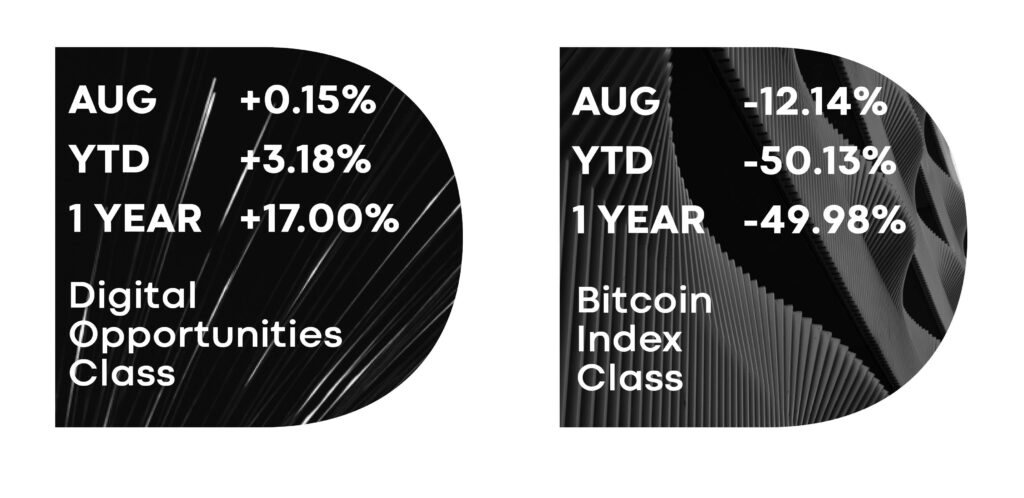

August performance and newsletter

It’s all about the Merge and our positioning around this to ensure no surprises from the myriad of complex instruments that we trade, whilst simultaneously trying to take advantage of this event. The expected PoW token drop on the split from PoS has created distortions in the markets, resulting in yields of greater than negative 100% APY in the short term.

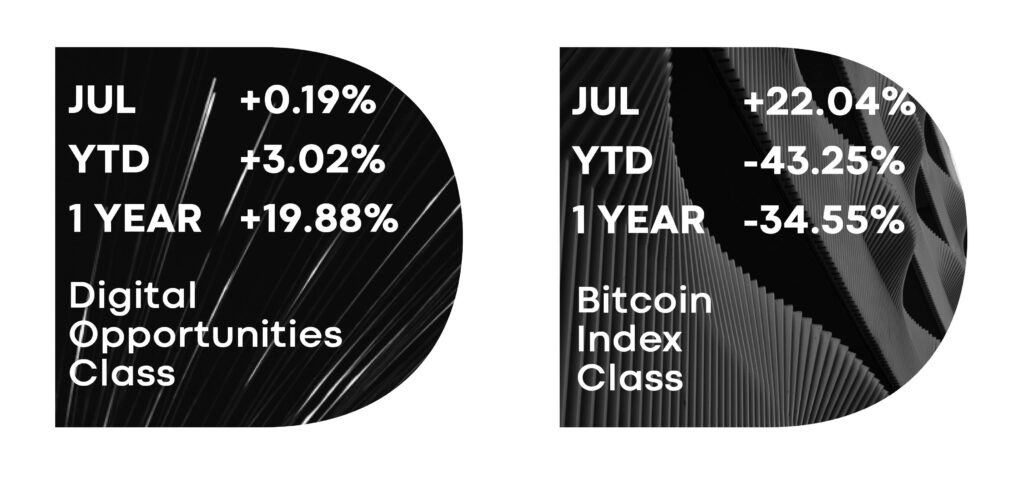

July performance and newsletter

It was a month where the Crypto markets seemed to take a breath after the tumultuous events of June. Crypto Markets rallied overall but there was little conviction in most participants and that kept leverage/yields muted, and thus trading opportunities limited. The announcement of the Ethereum Merge date came into focus and the staking rewards on offer in ETH 2.0 has been another factor depressing yields.

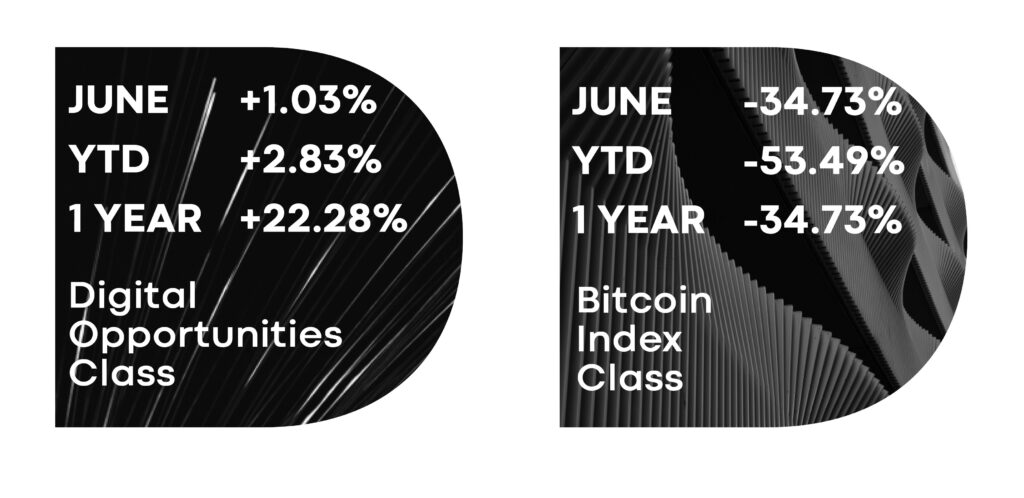

Barclay Hedge Award June 2022

The Digital Opportunities Class posted its 14th consecutive positive monthly return and was ranked 6th in the Barclay Hedge monthly performance ranks.

June performance and newsletter

Yields remain depressed however we were able to take advantage of the volatility more so than other months this year. We continue to add to the suite of products and evaluate additional exchanges that the algorithm can consider in its trading decisions. With the perpetual improvements to the system we remain as confident as ever that we can take advantage, in a risk neutral fashion, of any opportunities that the market presents and add to our 14 consecutive positive months in all market conditions.

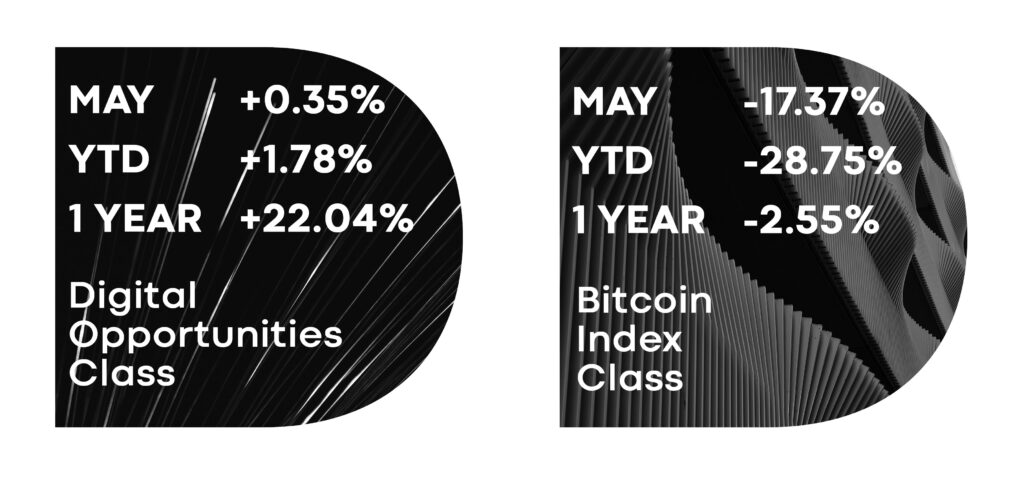

May performance and newsletter

With the collapse of Terra and the extreme volatility we took an even more cautious approach to our risk parameters. Whilst the magnitude of opportunities of previous corrections didn’t eventuate we were able to trade 24/7 without incident and record 13 straight months of positive results.